Skip to main content

Description

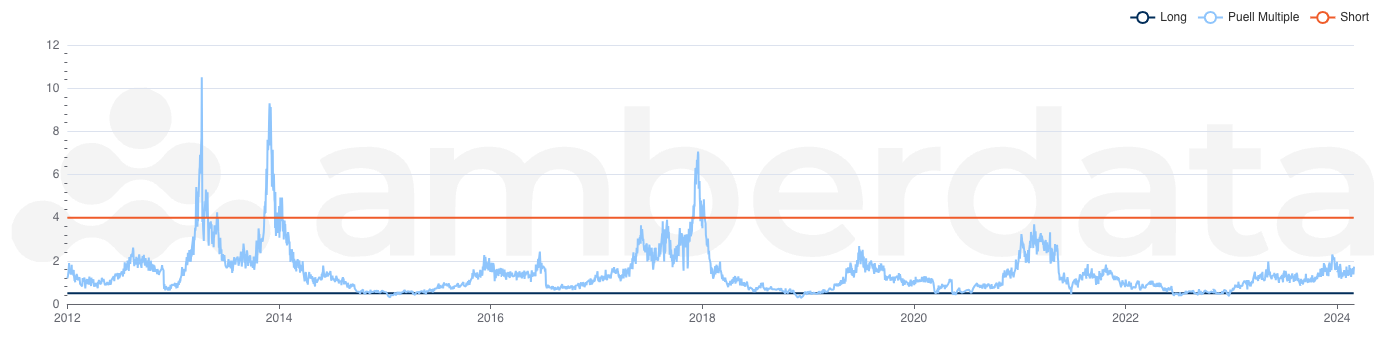

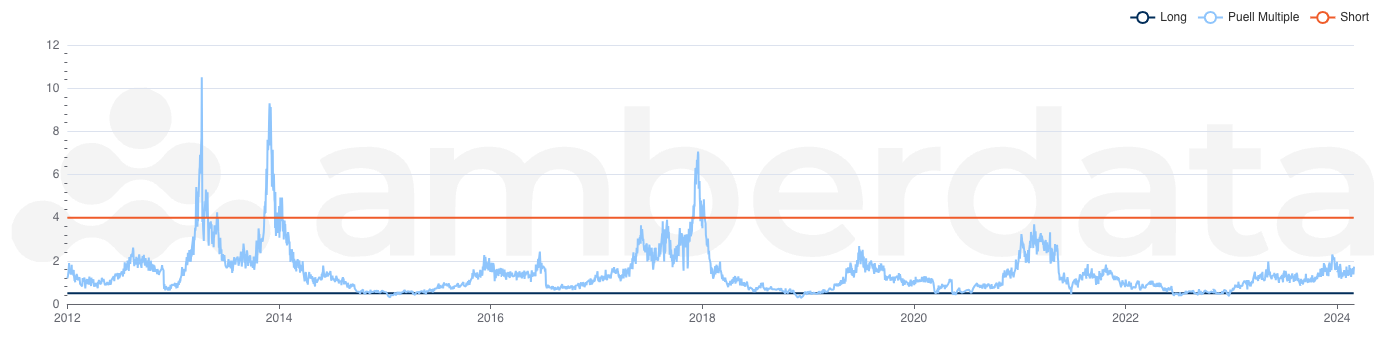

The Puell Multiple is a market indicator that measures Bitcoin miner profitability relative to historical norms. It reflects price movements and is used to identify phases within the broader Bitcoin market cycle.

When the Puell Multiple is low, it means the daily USD value of newly minted BTC is below its yearly average—often signaling potential market bottoms. Conversely, high values suggest that newly minted BTC is worth more than the annual average, which may indicate overheated conditions and potential market tops.

This metric implicitly assumes that miner operational costs are relatively stable. As the price of Bitcoin rises, so does the value of mined BTC, improving miner profitability.

Use Cases

**Traders **use the Puell Multiple as a signal for when miner revenue is higher than historical norms and when the price is likely to drop (being too high) or bounce (being too low).

Analysts use the Puell Multiple to forecast trends in Bitcoin prices.

**Researchers **use the Puell Multiple to help determine the current trading cycle.

Methodology

Puell Multiple = Daily Issuance Value (USD) ÷ 365-Day Moving Average of Daily Issuance Value (USD)

- Daily Issuance Value: The total USD market value of BTC newly mined each day.

- 365-Day Moving Average: The rolling one-year average of the daily issuance value.

This ratio normalizes daily miner revenue against a long-term average, allowing for cycle-based analysis.

Frequently Asked Questions

What Puell Multiple value typically indicates miner profit or loss?

- A Puell Multiple of 1.0 or higher generally indicates that miners are operating at a profit. Values below 1.0 suggest that miners may be under financial pressure.

How often is the Puell Multiple updated?

- The metric is updated daily.