Options Trading

Note: This dataset is updated hourly and available via Databricks, Google BigQuery, and Snowflake.

Description

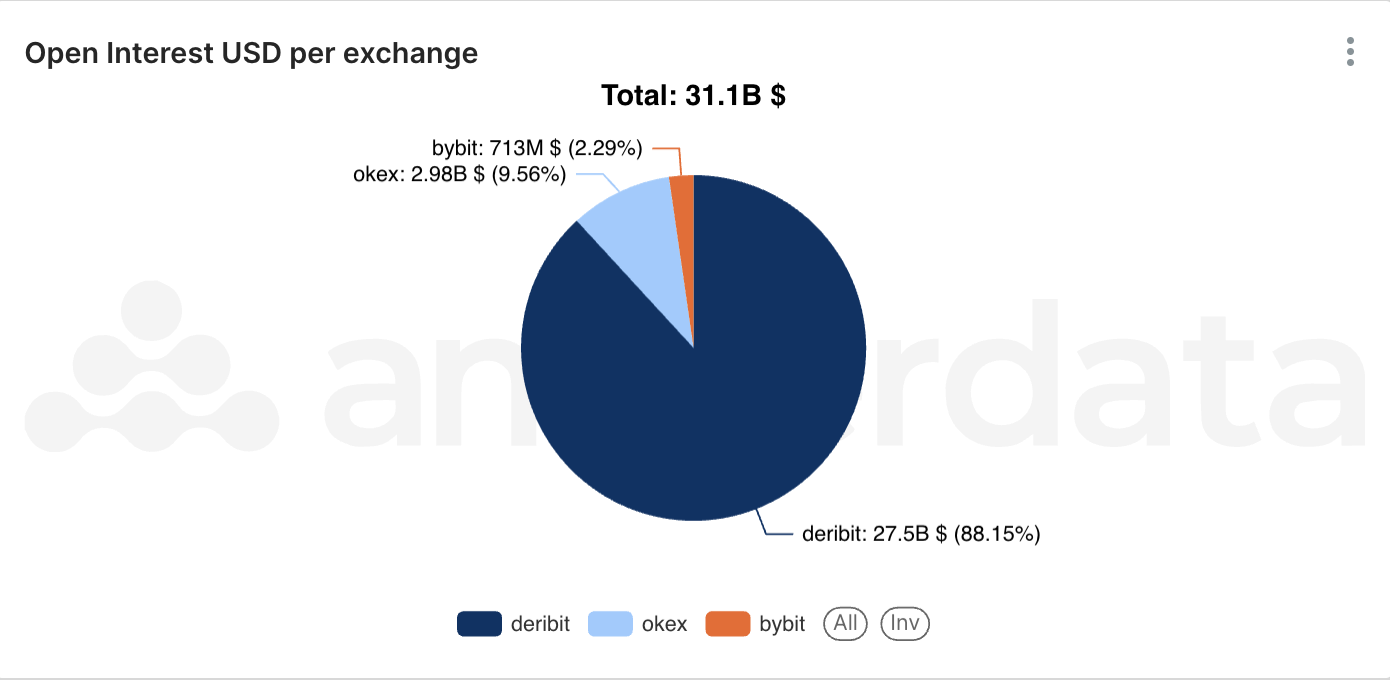

This dashboard provides key aggregations of volume and open interest for the entire cryptocurrency options market as monitored by Amberdata. Currently, this includes Deribit, Okex, and Bybit, which together represent approximately 95% of the total crypto options market.

All metrics on this page are expressed in nominal US dollar values.

- Volumes: Volumes represent the nominal values traded in the last 24 hours.

- Open Interest: Open interest represents the nominal values of open contracts.

Typically, high volumes and high open interest indicate significant activity and heightened volatility in the market.

For our full options analytics suite, please go to Amberdata Derivatives.

Use Case

Researchers

The data provide a comprehensive view of a growing market like that of options within the much broader sector of the derivatives market, still dominated by futures/swaps. Researchers can monitor trends over time and across different coins/exchanges to highlight ongoing market trends.

Analysts

For a complete picture of potential market strategies with an edge, keeping an eye on instruments with high open interest or high volumes can suggest some liquidity optimizations.

Methodology

The data uses this endpoint and is updated hourly and aggregated from the fundamental unit of each instrument/exchange. Each exchange has its technical specifications for its target market, with quotes that may be in coins (e.g., BTC options on Deribit) or stablecoins (e.g., BTC options on Bybit quoted in USDC). Therefore, conversions from contract values to dollar values have been made, taking into account the specific multiplier differences for each instrument/exchange.

Updated about 2 months ago