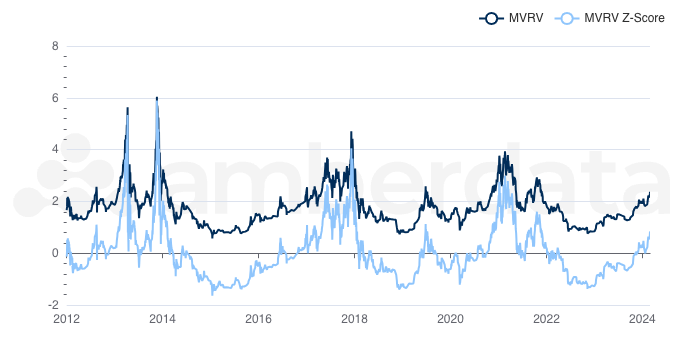

Market Value: Realized Value (MVRV)

Description

The MVRV Z-Score compares the network’s market value to the realized value. It is used to predict top and bottom prices at the extremes of market conditions and to determine if an asset's realized value is overvalued or undervalued relative to its market value.

When the market value is significantly greater than the network value (high z-score), the market is often near a market top. When the market value is significantly less than the network value (low z-score), the market is often near market lows.

We cover ETH and BTC MVRV.

Use Cases

This metric is useful to determine the state of the market and its current phase, compare historical market highs and lows with other commodities, and can be used to buy the network low and sell a network high when the network realized value is significantly greater or less than the market value.

Methodology

MVRV Z-Score = (Market Cap - Realized Cap) / Std(Market Cap)

The standard deviation of market cap is cumulative from the first available data points to the current date.

Updated about 2 months ago