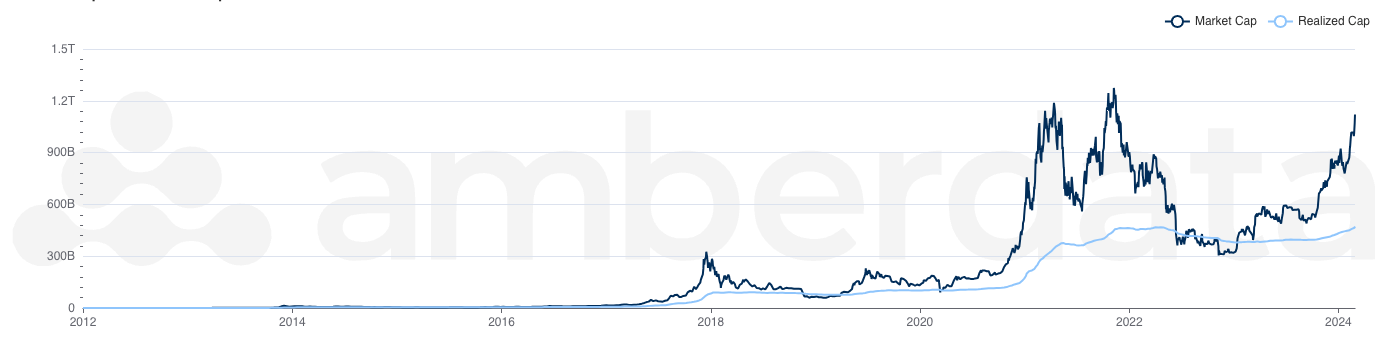

Market Cap vs Realized Cap

Description

Realized Capitalization (Cap) is the value of each asset based on the price it was last moved.

We cover ETH and BTC market cap vs realized cap.

Use Cases

The Realized Cap can be used as an alternative to Market Cap, where the realized cap is the price of all assets at the last time they moved while the market cap is the price of all assets at the current price. Realized cap can also represent the value of all coins in the network, and can serve as an aggregate cost basis for the network.

Given the methodology to calculate this metric, older assets have a significant weight on the realized cap given their age and the lower price at which they last moved. When older tokens move, the lower price of those tokens is then re-valued at the new price and can create a large shift in realized cap.

When Realized Cap > Market Cap, the network is out of profit and is in an aggregate loss. When Realized Cap < Market Cap, the network is in profit and is in an aggregate profit.

Methodology

Market Cap = supply * price

Realized Price = Amount * Price at Time Created

Note: For UTXOs like BTC, this is an easy calculation because when a UTXO is spent, it’s easier to calculate the price of the token when it was created. For ETH, this process is harder because it is an account-based chain.

We take the Last in First Out (LIFO) stack based accounting method for determining ETH price, inspired from Santiment (Stack Coin Age model | Santiment Academy).

Updated about 2 months ago