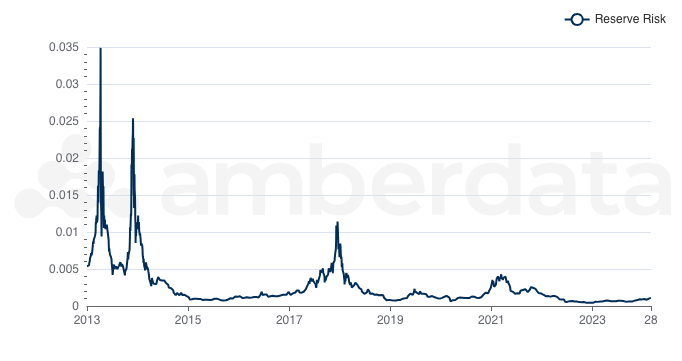

Reserve Risk

Description

Reserve Risk is the confidence of holders relative to price and can be interpreted as a confidence score of long-term holders. When confidence is high and the price is low, Reserve Risk (low) can indicate that it is a good time to buy – buying when reserve risk is low generates oversized returns. However, when confidence is low and the price is high (reserve risk is high), the indicator is a sell signal – there is too much risk.

We cover BTC Reserve Risk.

Use Case

Reserve risk can help traders understand when it is a good time to buy and researchers to analyze the confidence of long-term holders.

Methodology

Reserve Risk = Price / HODL Bank

HODL Bank = cumulative sum(price - median value of Coin Days Destroyed)

Updated 2 months ago