Stock-to-Flow

Description

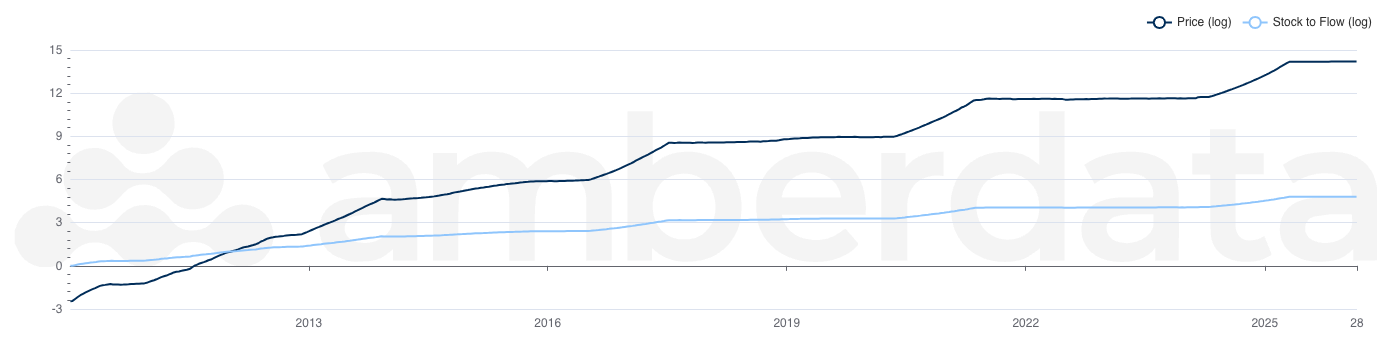

The stock-to-flow model is a number that indicates the number of years it will take to attain the current stock (supply) at the current production rate and is commonly used to price commodities. As its name suggests, the model evaluates an asset's scarcity by comparing its existing supply (stock) to its annual production rate (flow).

In Bitcoin's case, its programmed scarcity and predictable issuance, through halving events reducing new coin creation, contribute to its increasing stock-to-flow ratio over time. This model has been utilized to forecast Bitcoin's price trajectory, guide investment strategies, analyze market trends, and manage risk. While it's not immune to criticism, the stock-to-flow model provides valuable insights into Bitcoin's unique economic properties and its potential as a digital store of value.

We only cover Bitcoin's stock-to-flow.

Use Case

Price forecasting: Investors and analysts use the model to predict future price movements of Bitcoin based on its scarcity dynamics.

Investment strategy: Traders and investors may incorporate the Stock-to-Flow model into their investment strategies to assess the long-term value proposition of Bitcoin and make informed decisions about buying, holding, or selling.

Market analysis: The Stock-to-Flow model provides insights into the fundamental factors driving Bitcoin's price and can be used alongside other analytical tools to analyze market trends and behavior.

Risk management: Understanding Bitcoin's scarcity properties through the Stock-to-Flow model can help investors manage risk by assessing the potential impact of supply-side dynamics on price volatility.

Methodology

We use our Stock-to-Flow Amberdata endpoint

Updated 2 months ago