Puell Multiple

Description

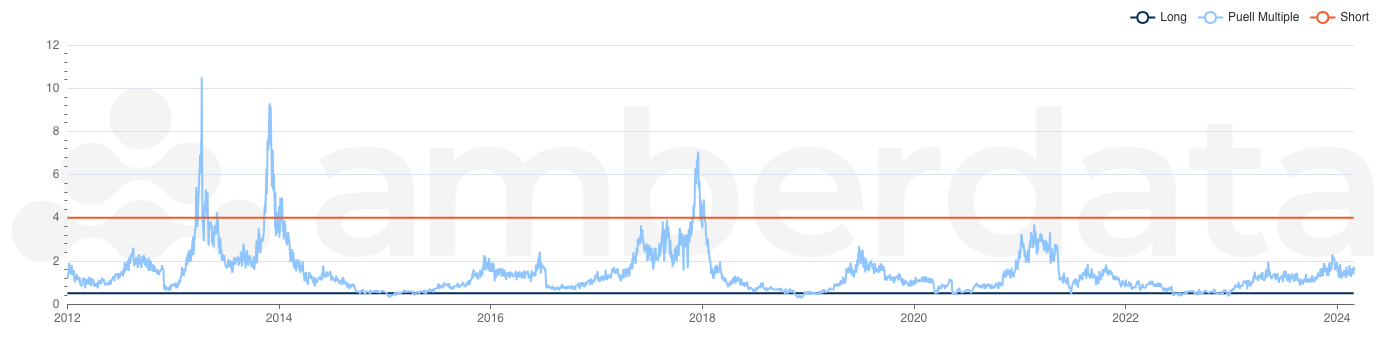

The Puell Multiple is an indicator on miner profitability, which reflects price movements and helps to determine market cycles. In simple terms, when the Puell Multiple is low, the value of newly minted BTC is lower than the yearly average and conversely when it’s high, the value of newly minted BTC is higher than the yearly average. High Puell Multiples indicate a market top and low multiples indicate a bottom. Another way to think of it is if the Bitcoin price is rising, the miner should be making a profit (or a larger profit than previously). However, this does assume the miner's costs are stable.

Use Cases

Trader

Traders can use the Puell Multiple as a signal for when miner revenue is higher than historical norms and when the price is likely to drop (being too high) or bounce (being too low).

Analyst

An analyst can use the Puell Multiple to forecast trends on Bitcoin prices.

Researchers

Researchers can use the Puell Multiple to help determine the current trading cycle.

Methodology

Puell multiple = daily issuance value (USD) / 365 day MA of daily issuance value

Daily Issuance Value = The market value of newly minted Bitcoins generated through mining on a daily basis (usually calculated in USD).

365-day MA of Daily Issuance Value = The yearly average value of the daily market value of newly minted Bitcoins (usually calculated in USD).

Frequently Asked Questions

Is there a general rule for which Puell Multiple Indicates Miner Profit/Loss?

- Yes. Typically, a Puell multiple of 1.0 or higher indicates miners are in profit and below 1.0 they are experiencing losses.

How often is this chart updated?

- Daily.

Updated about 2 months ago