New Address Momentum

Description

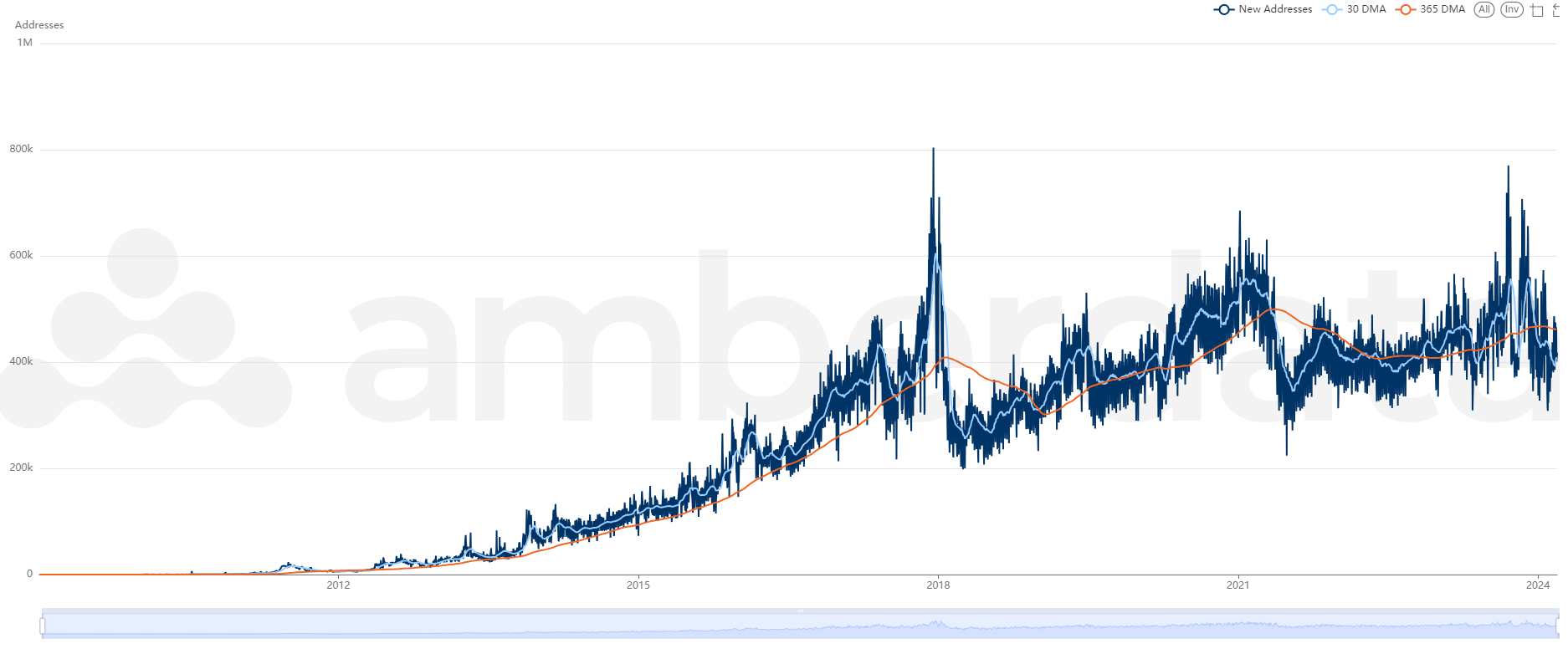

The New Address Momentum provides insights into the activity and growth of addresses within the cryptocurrency ecosystem. It encompasses various metrics, including the total number of unique addresses, new addresses (both inputs and outputs), passive addresses with inputs, active addresses with outputs, and the moving averages of new addresses over 30 and 365 days. Active addresses represent those involved in transactions, while passive addresses remain inactive. Notably, the inclusion of centralized exchanges (CEXs) accounts for significant address consolidation. This metric is crucial for understanding address dynamics and overall network activity.

We cover ETH and BTC for new address momentum.

Use Case

Trader

Traders can use these metrics to determine if active addresses increase (buy signal) or decrease (sell signal).

Analyst

Analysts can use these metrics to develop risk metrics on a network.

Researcher

Researchers can use these metrics to find the correlation between new addresses or addresses with transactions and other data such as ordinal transactions or ETF interest.

Methodology

New addresses (inputs and outputs):

- 30 Day MA: 30-day moving average (DMA) on new addresses (first input or output)

- 365 Day MA: 365-day moving average (DMA) on new addresses (first input or output)

Passive Addresses / Inputs:

- Daily inputs (addresses and transaction date)

- Passive Addresses: Number of addresses with an input per day

- New Inputs: Count distinct of every input address per day on the first instance of an address as an input

Active Addresses / Outputs:

- Daily outputs (addresses and transaction date)

- Active Addresses: Number of addresses with an output per day

- New Outputs: Count distinct of every output address per day on the first instance of an address as an output

Updated about 2 months ago