IV ATM

Definition

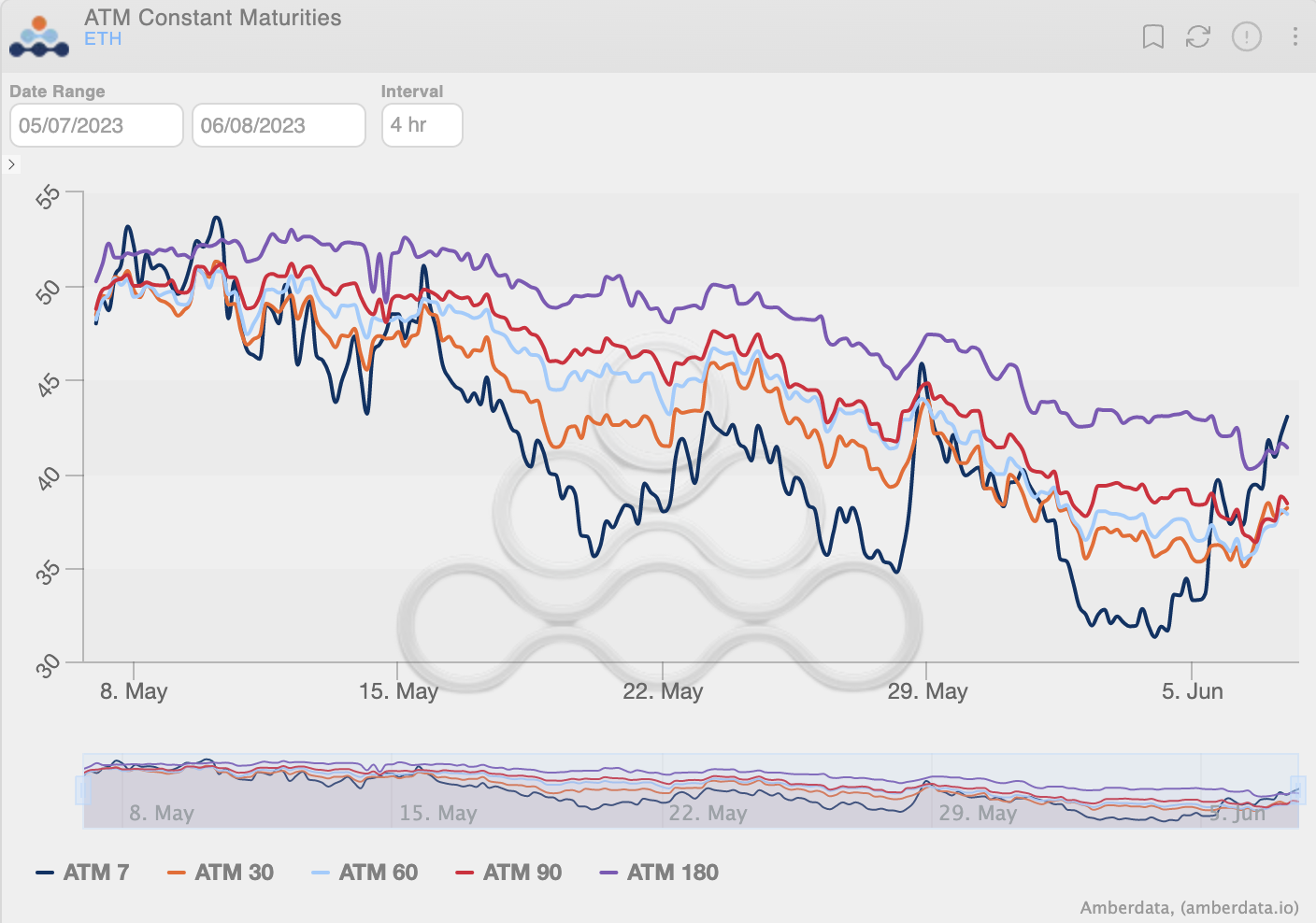

Our IV ATM Constant Maturities and IV ATM Floating Maturities endpoints equip you with a nuanced understanding of the implied volatility in the cryptocurrency options market. The IV ATM Constant Maturities endpoint examines implied volatility for options with constant maturities, while the IV ATM Floating Maturities endpoint looks at implied volatility for options with floating maturities.

Details

The IV ATM Constant Maturities endpoint provides an analysis of implied volatility for options with specific expiry dates, assisting in the prediction of future price fluctuations. It can help traders construct more informed trading strategies and hedge their portfolios more effectively.

Conversely, the IV ATM Floating Maturities endpoint focuses on options with floating maturities. This tool is particularly useful in identifying opportunities in a rapidly evolving market, giving traders the ability to act swiftly and decisively.

We ensure data reliability and consistency across various trading platforms through stringent data normalization and standardization. This approach assures users of the quality of the data we provide, empowering informed and strategic decision-making.

API Endpoints

[LIVE] IV ATM Constant Maturities

[HIST] IV ATM Constant Maturities Minute

[HIST] IV ATM Floating Maturities

FAQs

How can the IV ATM Constant Maturities endpoint assist in strategy construction and portfolio hedging?

- The IV ATM Constant Maturities endpoint provides a detailed analysis of the implied volatility for options with constant maturities. By helping to predict future price fluctuations, this tool can assist traders in constructing informed trading strategies and hedging their portfolios more effectively.

How is the IV ATM Floating Maturities endpoint useful in a rapidly evolving market?

- The IV ATM Floating Maturities endpoint focuses on options with floating maturities, which change with market conditions. This feature helps traders identify opportunities quickly in a rapidly changing market, enabling them to act swiftly and decisively.

What is the difference between constant maturities and floating maturities?

- Constant maturities refer to options with specific expiry dates while floating maturities refer to options whose expiry dates change with market conditions. Analyzing implied volatility for both types of maturities can provide traders with a more comprehensive view of the market and help them to identify diverse trading opportunities.

Sample Use Cases

Improving Trading Strategy with IV ATM Constant Maturities

One of the main applications of these endpoints is to utilize them for enhancing a trading strategy by understanding the implied volatility associated with options of constant maturities. This can help traders to make more informed decisions, hedge their portfolios effectively, and potentially increase their profitability.

Let's consider a trader who deals with options trading in the cryptocurrency market. The trader wants to improve their trading strategy by understanding the implied volatility associated with options of constant maturities. They also wish to hedge their portfolio effectively to minimize risk.

By utilizing the IV ATM Constant Maturities endpoints, the trader can gain a comprehensive understanding of implied volatility for options with constant maturities. This information would help them to predict potential future price fluctuations, improve their trading strategy, and hedge their portfolio more effectively.

Additionally, by understanding both the current and historical implied volatility, the trader can also identify patterns and trends that might influence future market movements. This can result in more informed decision-making, potentially leading to increased profitability and improved risk management.

Updated about 2 months ago