IV Skew

Definition

Our IV Skew Strike Delta, IV Skew Delta Buckets, and IV Skew Traded endpoints deliver a comprehensive examination of the distribution of the Implied Volatility (IV) across various strikes and deltas. These endpoints enable traders to analyze the asymmetry in the IV across different strike prices, understand the specific buckets of the delta where the skew is most pronounced, and identify the most traded IV Skews.

Details

The IV Skew Strike Delta endpoint provides an in-depth view of the implied volatility skew across various strike prices, helping to determine market sentiment and potential price biases.

The IV Skew Delta Buckets endpoint categorizes the IV skew into specific delta buckets. This method assists traders in identifying where the skew is most pronounced, which can be critical for developing effective strategies and spotting unique trading opportunities.

The IV Skew Traded endpoint offers insights into the most traded IV skews. Understanding where most trades are occurring can highlight the market's focus and indicate potentially lucrative areas for investment.

Our service guarantees reliable and standardized data across various trading platforms, promoting robust and informed decision-making.

API Endpoints

FAQs

What insights can I gather from the IV Skew Strike Delta?

- The IV Skew Strike Delta allows traders to analyze the skewness or asymmetry in the implied volatility across various strike prices. This information is valuable in assessing market sentiment and potential price biases.

How can the IV Skew Delta Buckets endpoint assist me in formulating trading strategies?

- By segmenting the implied volatility skew into specific delta buckets, you can identify where the skew is most pronounced and spot unique trading opportunities. This granular view of the IV skew can help shape effective strategies tailored to your risk tolerance and investment objectives.

How can the IV Skew Traded endpoint aid in identifying lucrative trading opportunities?

- The IV Skew Traded endpoint provides insights into the most traded IV skews. By understanding where the majority of trades are occurring, you can identify the market's primary focus and pinpoint potentially profitable areas for investment.

What role does the IV Skew play in options trading?

- In options trading, the IV skew is a valuable indicator of market sentiment. A positive skew, where out-of-the-money puts have higher IVs than out-of-the-money calls, typically indicates that the market is more concerned about potential downside risks. Conversely, a negative skew might suggest the market is anticipating an upward price movement.

Example Use Cases

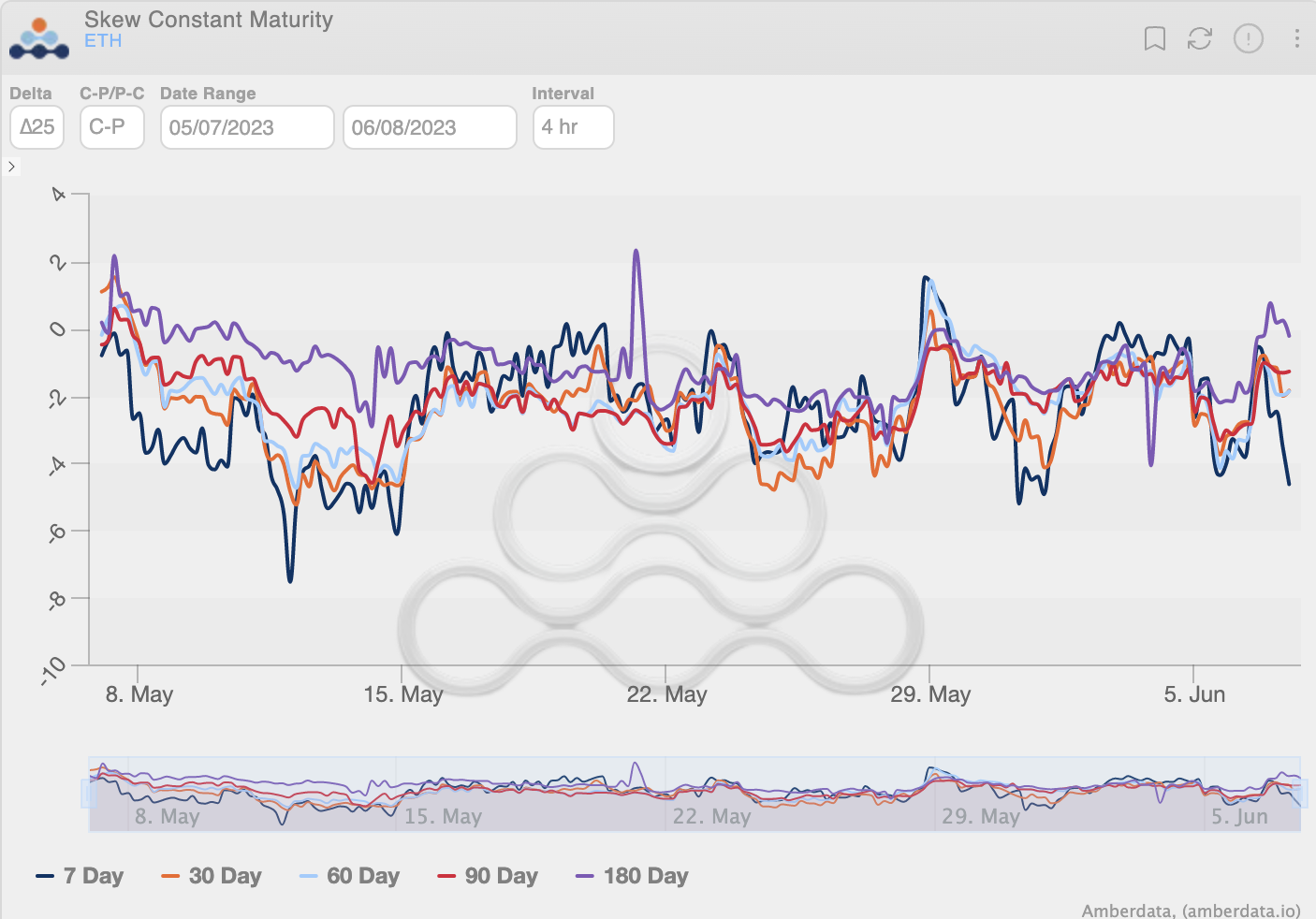

Monitoring and Leveraging IV Skew Dynamics

One of the applications of these endpoints is monitoring the IV skew dynamics over time and leveraging this information for options trading. Traders and investors can use these tools to gain an edge in the options market, making more informed decisions based on the market's overall sentiment and the most traded skew levels.

Imagine an options trader who wants to gain more insights into the market's sentiment and find lucrative trading opportunities. They are particularly interested in the skewness of implied volatility across different strike prices and delta buckets, as well as the most traded IV skews.

By utilizing these endpoints, the trader can gain a detailed understanding of the IV skew dynamics in the options market. They can use this information to make more informed decisions about their trading strategy, based on the market's sentiment, the most pronounced skew levels, and the most traded skew levels. This can potentially result in more profitable trades and improved risk management.

Additionally, this use case illustrates the importance of incorporating market dynamics and sentiment into trading strategies. By analyzing the skewness of implied volatility across different strike prices and delta buckets, as well as the most traded IV skews, traders can get a deeper understanding of the market's overall sentiment and where it's focused, providing them with a competitive edge in the options market.

Updated 2 months ago